https://ift.tt/3roFBr8

Note: This is as of December 31st.

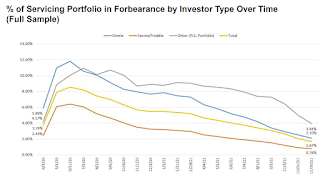

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 1.41% in December 2021

The Mortgage Bankers Association’s (MBA) new monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 26 basis points from 1.67% of servicers’ portfolio volume in the prior month to 1.41% as of December 31, 2021. According to MBA’s estimate, 705,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 8 basis points to 0.68%. Ginnie Mae loans in forbearance decreased 47 basis points to 1.63%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 51 basis points to 3.43%.

“The share of loans in forbearance continued to decline in December 2021. This was especially the case for government and private-label and portfolio loans, as those loans have higher levels of forbearance than loans backed by Fannie Mae and Freddie Mac,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “With the number of borrowers in forbearance continuing to decrease below 750,000, the pace of monthly forbearance exits reached its lowest level since MBA started tracking exits in June 2020.”

Added Walsh, “It is likely that the remaining borrowers in forbearance have experienced either a permanent hardship that may require more complex loan workout solutions, or they have encountered a recent hardship for which they are now seeking relief.” emphasis added

This graph shows the percent of portfolio in forbearance by investor type over time. The number of forbearance plans is decreasing rapidly recently since many homeowners have reached the end of the 18-month term.

Financial Services