https://ift.tt/3nhqgXY

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. However, prior to the pandemic, the Inland Empire was coming back strong.

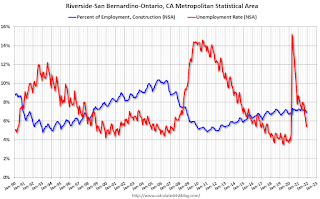

This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate was falling before the pandemic and was down to 3.6% (down from 14.4% in 2010). During the pandemic, the unemployment rate increased to 15.2%, but is down to 5.4%.

So, the Inland Empire economy isn’t as heavily depending on construction as during the bubble.

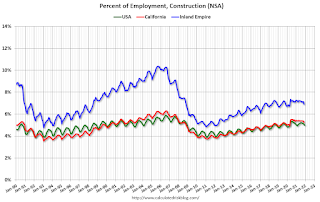

Clearly the Inland Empire is more dependent on construction than most areas. Construction employment – as a percent of total employment – has picked up but is still below the levels during the housing bubble.

Financial Services